WHITE PAPERS

401(K) PLAN PARTICIPANT LOANS – WHAT TO KEEP IN MIND

Employers have the option to allow their employees to take loans from their retirement plan balances.

The loan plan provision would allow an employee to borrow up to 50% of their vested account balance, not to exceed $50,000 (If the participant has not had a loan within the last 12 months).

The loan provision may encourage employees to contribute to the retirement plan knowing they have an option to use those funds later if an emergency occurs. The benefits of a loan option in a retirement plan include:

1. Employees do not have to prove credit worthiness to obtain a loan.

2. The loan repayments are easily deducted from an employee’s paycheck.

3. There are no early repayment penalties.

4. Typically, loan interest rates are 1% or 2% over prime. The interest rate could be lower than what the employee could obtain through a financial institution.

5. Both the interest and the principal payments are deposited to the employee’s retirement plan account.

When deciding to offer loans in retirement plans, employers should consider the following:

1. Employers establish the loan repayments on the employee’s payroll. An employer is responsible for any administrative error if loan payments are not submitted timely to the participant’s retirement account. Payroll errors could result in the loan defaulting.

2. If an employee is terminated and has an outstanding loan balance, the loan would need to be quickly repaid or the loan would go into default and become taxable (and penalized if the employee is under age 59 ½).

3. When an employee takes a loan from the plan, it can significantly impact their retirement savings goals. The employee may not be able to afford employee deferral contributions while making the loan repayments. If the retirement plan offers a match contribution, the employee would miss out on the match contributions deferrals ceased. When taking the funds out of the market, the overall performance of the employee’s retirement account can be impacted.

Benefit Administrators, LLC can help employers decide whether to offer the loan benefit to their employees. We can discuss the specific needs within your company to help you get to the best decision for your retirement plan.

WHAT DOES A TPA DO?

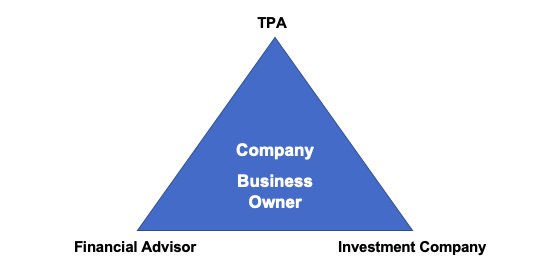

A Third-Party Administrator (TPA) is one of the most important components in managing your company’s retirement plan, allowing you to focus on running your business.

We work closely with your financial advisor and investment company to handle the day- to-day administration associated with your retirement plan. This keeps the retirement plan in compliance with the Internal Revenue Service (IRS) and the Department of Labor (DOL).

Benefits Administrators will assume the administrative role for your plan, thereby making your work day easier and less stressful. Your company will be offered a single point of contact who is familiar with your business and your retirement plan. By working with our firm, you will have a TPA that keeps abreast of current laws and regulations governing your plan. In addition, since we are independent, we will act in the best interest of your retirement plan and your business.

Our services include, but are not limited to:

-Customized plan design to meet your goals

-Develop and maintain your plan document

-Monitor your plan and recommend improvements

-Annual census analysis, including determination of highly compensated

-Required compliance testing specified by your plan design

-Form 5500 reporting

-Required annual notification and disclosures

-Participant distribution services

-Tracking outside assets

-Payroll submission oversight

A well-designed plan will reduce your company’s costs, saving the business far more in income taxes. Benefits Administrators will provide plan critical services in a cost-effective manner.

WHAT IS A FIDELITY BOND?

The Employee Retirement Income Security Act (ERISA) requires that people who handle plan funds must be covered by a fidelity bond to protect the plan from losses due to fraud or dishonesty. The fidelity bond must be obtained from an insurance company, listing the plan itself as the insured. Also, the bond can be added as a rider to your company’s liability insurance policy, naming the plan separately, or as a separate bond policy based upon the advice of your insurance agent.

Fidelity bonding should cover all employees of the employer who handle plan funds or other property by virtue of their job duties. Please note this coverage should not be limited to trustees of the retirement plan.

The bond coverage should equal 10% of plan assets. As an example, if the retirement plan assets are valued at $1,000,000, the bond should be $100,000 at a minimum. However, the maximum bond amount required is $500,000 regardless of the asset amount of the retirement plan.

The Department of Labor (DOL) gathers this information on your annual Form 5500 by asking the question:

“Was the plan covered by a fidelity bond?”

Yes No N/A Dollar Amount of Bond______________

Benefits Administrators requests this information annually from each of our clients so that we provide the updated information to the DOL on your behalf. If you have any questions regarding the fidelity bonding requirement, please contact your Retirement Plan Coordinator.